In recovery, you may hear a lot about emotions, self-awareness, and spirituality. While these points are important, many people in recovery also have questions about everyday things. This includes things they will need to manage outside of rehab, such as their finances. Many addicts use up their entire life savings to fuel their addictions, leading many with drug and alcohol problems into homelessness, poverty, and debt. Even those in recovery who did not have a previous money problem may find themselves spending money simply for the rush of adrenaline it causes. If you are looking to improve your financial situation after rehab, our Banyan Palm Springs rehab is sharing tips on money management for recovering addicts that can help.

Drug Addiction and Financial Problems

As we previously mentioned, there are many financial consequences of drugs and alcohol. At the end of the day, drugs and alcohol cost money, and most people with severe substance use disorders will pay whatever they have to so they can get their fix. Unfortunately, this tends to leave them in a deep financial hole.

Addiction is a long-term disease that intensifies over time. Without drug or alcohol treatment, the individual may continue to spend money to abuse these substances without realizing the damage it’s doing to their health and bank account. Many addicts will go to great lengths to ensure they have the substances they want, including stealing money from loved ones and getting into a chain of borrowing money.

What is worse is unemployment and addiction go together. This is because it is usually challenging to hold down a job when you are coming to work high, drunk, hungover, or when you are constantly late or do not show up because of substance abuse. There are also various (expensive) legal problems that may present themselves because of your drug or alcohol use, such as separation, divorce, and child custody battles.

It is also common for addicts to fall into criminal activity, which can also lead to expensive hearings and cases. It is no secret that drugs and alcohol do not do much for your health, so it is no surprise that many addicts also fall into a financial hole when it comes to medical bills. When considering these factors, it’s understandable why many addicts struggle to manage their finances in recovery and even after their treatment.

Why Is Budgeting Important in Recovery?

For those who struggle with rebuilding their finances after rehab, budgeting is essential. Significant life adjustments, such as possible changes in housing or work status, are frequently a part of early recovery. A carefully thought-out budget assists people in setting priorities for necessities such as housing, healthcare, and food, guaranteeing that these needs are satisfied without placing an excessive burden on their finances. Individuals in recovery should steer clear of situations that could exacerbate their addiction by setting realistic spending limits and clearly defining boundaries with regard to money.

Budgeting also fosters a sense of financial responsibility and accountability. It motivates people to keep tabs on their expenditures, pay attention to their financial behaviors, and make wise financial decisions. This increased awareness aids in preventing impulsive spending, which, for some people in recovery, can be a major risk factor for relapse. A well-planned budget also makes it possible for people to set aside funds for crucial activities linked to rehabilitation, such as counseling, joining a support group, and engaging in wellness routines. In the end, good budgeting gives people back control over their money, which promotes a sense of security and stability that is essential for maintaining long-term recovery.

Money Management for Addicts in Recovery: Tips That Can Help

Financial assistance for recovering addicts is a hot topic in rehab, as substance use disorders can present numerous money problems. Personal finance is a crucial aspect of life that needs to be responsibly managed. Recovery offers the individual an opportunity to use their newfound skills in many areas of their life, including their finances, to improve their situation.

But how? Below are some tips on money management for recovering addicts that can help you or a loved one.

Organize Yourself

The first step to improving your financial situation after addiction is to fully understand the severity of your debt. An effortless way to organize yourself is to make a list of your debts, assets, and monthly bills and then open a bank account. Make sure to detail to whom you owe money and how much income you have, including whether you have any savings, and any monthly bills you have. This is the groundwork you will need to take the necessary steps to fix your credit score after rehab, work on paying your debt, and improve your finances in recovery.

Establish Your Financial Goals

With the information you have, you can determine your financial goals for the next year or longer. These may vary from person to person, so do not compare yourself to others. Some goals include prioritizing debts that need to be paid, building up your savings, increasing your income, and more. Again, your goals are dependent on the nature of your financial situation.

Make a Plan

Having a written, organized plan will give you perspective and keep you on track. You can make a list of financial goals or a plan that you would like to accomplish by a certain date. It can look something like this:

- Goal #1: Save $1,000 a month from January to May for an emergency fund

- Goal #2: Pay off $400 credit card debt

- Goal #3: Pay off a $900 loan from family

- Goal #4: Pay off a $2,000 medical bills

The idea is to create a snowball effect in which, as debts drop off, you will have more money to put toward other debts, even if they are larger.

Create a Budget

Sustaining a budget is key to ensuring you get your finances back on track and keep them there. This means tracking everything you make and what you spend to find out what you are spending on food, electricity, water, transportation or gas, coffee with friends, and more. Knowing how much is going in and out every month will help you ensure your money is going in and out of the right places. Over time, this steady budget will allow you to manage your finances once you have less debt and more money to spend.

Do Not Underestimate the Costs of Little Things

Especially if you have debt, do not overlook the costs of little things that can potentially prevent you from making large payments and knocking out any debts more quickly. Some small expenses that tend to eat away at your budget include:

- Cable, magazine subscriptions, phone applications, and other subscriptions or streaming services

- Eating out

- Getting your hair and/or nails done professionally

- Smartphones and other technology

- Shopping

Even if you shop in thrift stores, you are spending more than you should. Remember that every dollar you save and put towards paying off your debt matters. Putting every penny towards debt also lowers the amount of interest that accrues on that debt. In other words, the faster you pay off your debt, the more money you are saving and the less you are spending.

Achieve Balance

If you have been struggling with your finances in recovery, nothing will be as satisfying as finally paying off your debt. Now, the income you make can be saved and go towards things you want. However, going back to our budget, the goal of achieving financial stability in addiction recovery is not just to get out of debt but to learn how to live a balanced lifestyle when it comes to spending, making, and saving money. For this reason, we encourage you to include any additional expenses in your budget to ensure they make sense and that you will not end up back at square one.

How to Make Money After Rehab

One of the most effective ways to build finances in addiction recovery is to secure a stable job. Reentering the workforce after treatment can be an important step in starting the process of repairing your life. In order to determine possible job routes, start by evaluating your interests and skills. Think about looking for counseling services or support organizations that assist people in recovery in locating jobs. They can offer advice on developing a strong CV and perfecting your interview techniques. Additionally, look through online job boards and regional job fairs to find positions that fit your goals and skill set.

Another effective strategy for finding work after rehab is networking. Make the most of your current network and think about joining organizations in your town or career. Meet possible coworkers and employers by going to networking events, seminars, and workshops. Keep in mind that your experience in treatment shows tenacity and determination—qualities that many companies find very appealing. When talking about your history, highlight the constructive actions you've taken to heal and stress your dedication to developing personally. You'll improve your chances of landing a rewarding career after treatment if you approach your job hunt with tenacity and an open mind.

Never forget that choosing an occupation that fits your ambitions and provides a supportive atmosphere is more important than just securing any old job. Take into account jobs that offer a good work-life balance as well as those that will help you sustain your newly discovered sobriety. Looking for jobs that provide wellness and mental health resources can be quite helpful during this change. You'll be positioning yourself for long-term success and stability if you give your health an equal priority to your professional goals.

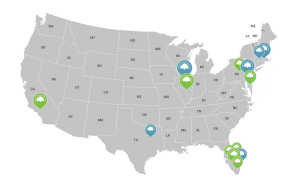

Drug Addiction Help in California

Financial help for recovering addicts is only one of the many topics the specialists at our Southern California rehab address in treatment. Our facility offers a variety of substance-specific treatment programs, as well as a center for medical detox in California that safely and effectively addresses withdrawal symptoms.